Cell Counting Industry

Summary:

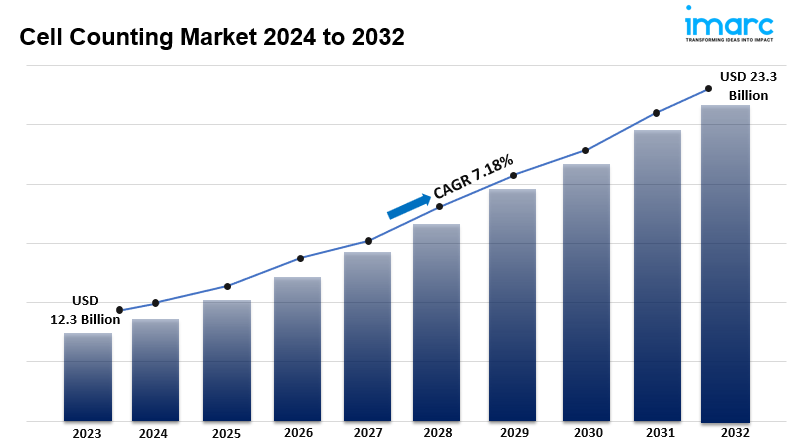

- The global cell counting market size reached USD 12.3 Billion in 2023.

- The market is expected to reach USD 23.3 Billion by 2032, exhibiting a growth rate (CAGR) of 7.18% during 2024-2032.

- North America leads the market, accounting for the largest cell counting market share.

- Consumables dominates the market due to their recurrent use in laboratory procedures.

- Research and academic institutes hold the predominant position as they play significant role in advancing biomedical research.

- The adoption of cell counting methods in drug development and research is a primary driver of the cell counting market.

- The cell counting market growth and forecast highlight a significant rise due to the technological innovations that are being integrated with cell counting methods to ensure precision and efficiency.

Industry Trends and Drivers:

- Increasing Adoption of Cell-Based Research and Drug Development

The cell counting market share is witnessing expansion due to the adoption of cell-based research and drug development processes. Cell counting plays a crucial role in cell culture studies, which are essential in biotechnology, pharmaceuticals, and medical research. Accurate cell counting is necessary for drug screening, gene therapy, and cancer research. With the rise in demand for personalized medicine and biopharmaceuticals, accurate cell measurement is essential to ensure the success of clinical trials and drug formulations. Moreover, advancements in technology have improved the precision and efficiency of cell counting instruments, making them essential for researchers and laboratories. As scientific discoveries and personalized medicine continue to evolve, the cell counting market is expected to increase, driven by the need for reliable and accurate measurements of cell populations in these advanced applications.

- Automation and Digitalization of Cell Counting Methods

The cell counting market trends indicate a shift toward automation and digitalization in cell counting techniques. Automated cell counters and digital cell counting systems are gaining traction due to their ability to provide faster, more accurate, and reproducible results compared to traditional manual methods. These innovations enable high-throughput cell counting, which is especially beneficial in large-scale research, drug development, and clinical diagnostics. Automated systems also reduce human error and labor costs, making them highly attractive for research institutions and pharmaceutical companies. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into cell counting devices is revolutionizing the industry by providing real-time data analysis and decision-making capabilities. As these trends continue to evolve, the cell counting demand for automated and AI-driven cell counters is expected to rise, as they offer enhanced efficiency and precision. This trend is particularly noticeable in the field of cancer research, where large datasets are needed for drug discovery and clinical trials, further driving the demand for advanced cell counting solutions.

- Growth in Healthcare and Diagnostic Applications

The cell counting market size is expanding significantly due to the increasing applications of cell counting technologies in healthcare and diagnostics. Cell counting is essential for various diagnostic procedures, including blood cell counting in hematology, the analysis of immune cell populations in immunology, and cell viability assessments in clinical settings. The growing prevalence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, has heightened the need for precise diagnostic tools that can assess cellular health and immune responses. As healthcare systems worldwide invest more in advanced diagnostic tools, the demand for reliable and efficient cell counting solutions is growing.

Request Sample For PDF Report: https://www.imarcgroup.com/cell-counting-market/requestsample

Cell Counting Market Report Segmentation:

Breakup By Product Type:

- Consumables

- Reagents

- Assay Kits

- Microplates

- Accessories

- Instruments

- Spectrophotometers

- Flow Cytometers

- Hematology Analyzers

- Cell Counters

Consumables account for the majority of shares as they are essential for the preparation, analysis, and maintenance of cell samples and are hence used predominantly in cell counting.

Breakup By End User:

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Others

Research and academic institutes hold the leading market share due to their essential role in disease diagnosis, therapeutic development and advancing biomedical research.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Top Cell Counting Market Leaders:

- Agilent Technologies Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd. (Roche Holding AG).

- Merck & Co. Inc.

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.