Market Overview:

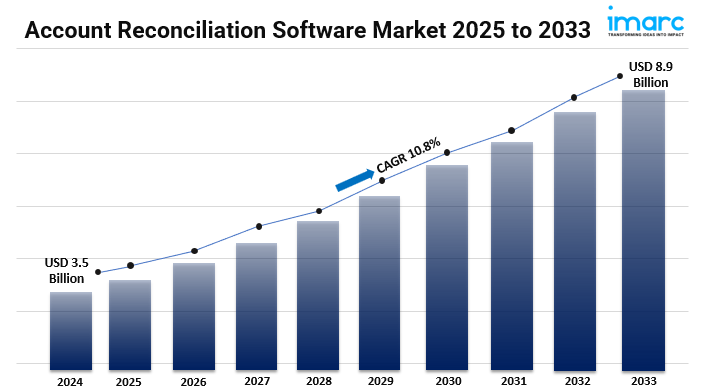

The global account reconciliation software market is experiencing significant growth, driven by the increasing need for efficient financial management solutions. Valued at USD 3.5 billion in 2024, the market is projected to reach USD 8.9 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 10.8% from 2025 to 2033.

Study Assumption Years:

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019-2024

- FORECAST YEAR: 2025-2033

Account Reconciliation Software Market Key Takeaways:

- Market Size and Growth: The market was valued at USD 3.5 billion in 2024 and is expected to reach USD 8.9 billion by 2033, growing at a CAGR of 10.8% during 2025-2033.

- Technological Advancements: Integration of advanced technologies like artificial intelligence and machine learning is enhancing the capabilities of account reconciliation software.

- Regulatory Compliance: Increasing regulatory requirements are driving the adoption of automated reconciliation solutions to ensure compliance.

- Operational Efficiency: Organizations are leveraging these tools to streamline financial processes, reduce manual errors, and improve accuracy.

- Market Expansion: The market is expanding across various sectors, including BFSI, manufacturing, retail, healthcare, IT and telecom, energy and utilities, and government.

Market Growth Factors:

Technological Advances: The application of AI and ML has considerably redefined reconciliation software in finance, such that it could be predicted that they would further bring automation of data matching, identification of abnormal patterns, and predictive analytics of visualizations for increased efficacy and precision in reconciliation. There is now a tilt to artificial intelligence and machine learning in finance, hence the promise for market growth in future years as this is going to drive the need for advanced reconciliation tools.

Regulatory Compliance: The changing regulations by different industries continue to tighten their noses around the financial reporting and compliance. It can also be said that as a last resort, accounts reconciliation software assures that no company goes down that road as it furnishes time-relevant verified financial data automatically, thus minimizing risks of non-compliance where the results tend to indicate. Certainly, this one of the most fundamental problems driving growth in this market.

Operational Effectivity: Having adopted account reconciliation software organizations are now boosting the efficiency of their cost-intensive financial activities, erasing manual errors, and pilling all productivity up for operations at an enterprise level. What will be routine processes with allocation of resources made possible is such that up overhead and operational costs lowered and better financial performance will be realized. Few developments will be as strong as this in driving the market for efficiency in operations, however.

Request Sample For PDF Report: https://www.imarcgroup.com/account-reconciliation-software-market/requestsample

Market Segmentation:

Breakup by Component:

- Software

- Services

Breakup by Deployment Mode:

- On-premises

- Cloud-based

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Breakup by End User:

- BFSI

- Manufacturing

- Retail and E-Commerce

- Healthcare

- IT and Telecom

- Energy and Utilities

- Government and Public Sector

- Others

Ask Analyst For Sample Report: https://www.imarcgroup.com/request?type=report&id=4891&flag=C

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights:

North America currently dominates the account reconciliation software market, holding a substantial market share. This dominance is attributed to early adoption of advanced financial technologies, a strong presence of key market players, and a favorable regulatory environment that encourages the use of automated financial solutions.

Recent Developments & News:

The account reconciliation software market is witnessing significant advancements, with key players introducing innovative solutions to enhance financial management processes. These developments focus on integrating artificial intelligence and machine learning to automate data matching and anomaly detection, thereby improving accuracy and efficiency. Additionally, there is a growing emphasis on cloud-based solutions, offering scalability and flexibility to meet the diverse needs of organizations across various industries.

Key Players:

- API Software Limited

- BlackLine Inc.

- Broadridge Financial Solutions Inc.

- Fiserv Inc.

- Intuit Inc.

- Oracle Corporation

- ReconArt Inc.

- Sage Group plc

- SmartStream Technologies ltd.

- Trintech Inc.

- Xero Limited.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.