UK Banking as a Service Market Overview

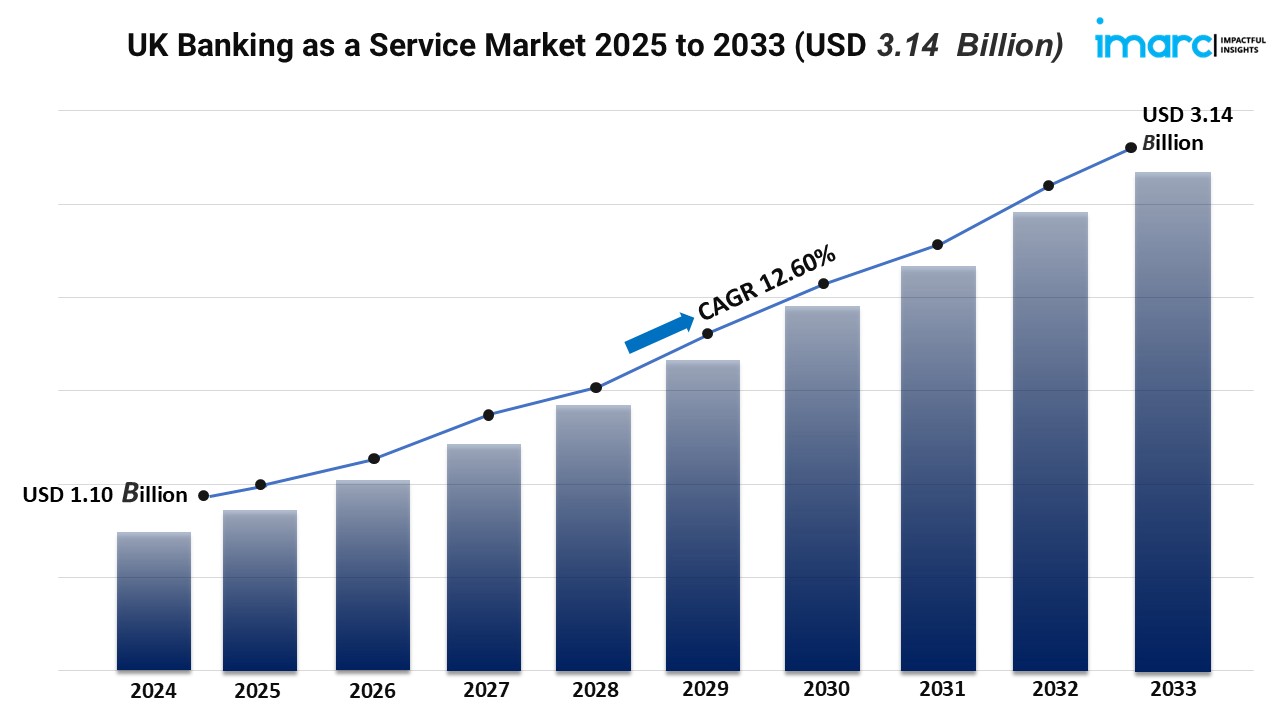

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1.10 Billion

Market Forecast in 2033: USD 3.14 Billion

Market Growth Rate: 12.60% (2025-2033)

UK Banking as a Service Market Trends and Drivers:

The UK Banking as a Service (BaaS) market is changing fast. This change is driven by the demand for embedded finance solutions in non-financial sectors. Businesses, from e-commerce to mobility services, are adding financial products like digital wallets and lending options into their customer journeys. Open banking regulations are speeding this shift.

They encourage collaboration between traditional banks and fintech innovators. The rise of API-driven banking infrastructure allows smooth connections between financial systems. This lets companies offer customized financial services without building their own solutions. Consumers now expect frictionless financial experiences on the platforms they use. This expectation creates new revenue streams for businesses using BaaS models.

Technology is key in shaping the market. Cloud computing and AI boost the scalability and personalization of BaaS offerings. Financial institutions team up with third-party technology providers to update old systems and meet changing regulations. The rise of real-time payment systems and blockchain solutions opens doors for new financial products. Small and medium enterprises (SMEs) benefit greatly from BaaS platforms.

They gain access to working capital solutions and automated accounting tools once available only to larger companies. Additionally, the growth of neobanks and challenger banks increases competition. This pressure pushes traditional banks to speed up their BaaS strategies to stay relevant.

Looking ahead, the market is set for steady growth. Cross-industry partnerships will create new ecosystems that blend banking with retail, healthcare, and more. The insurance sector is exploring embedded insurance products. The gig economy is using BaaS for instant earnings access and financial management tools. Regulatory sandboxes are promoting experimentation with decentralized finance (DeFi) integrations, which may unlock new use cases.

With rising investment in financial infrastructure startups and growing consumer comfort with digital banking, the UK Banking as a Service market is becoming a vital part of the country’s financial services evolution. It offers unmatched flexibility for both businesses and consumers.

UK Banking as a Service Market Report Segmentation:

The report provides an analysis of the key trends in each segment of the market, including the UK Banking as a Service Market size, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, application, and region.

Component Insights:

- Platform

- Service

- Professional Service

- Managed Service

Product Type Insights:

- API based BaaS

- Cloud-based BaaS

Enterprise Size Insights:

- Large Enterprise

- Small and Medium Enterprise

End-User Insights:

- Banks

- NBFC/Fintech Corporations

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/uk-banking-as-a-service-market/requestsample

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note:

If you need specific information that is not currently within the scope of the report, we can provide it as part of the customization.

About Us:

IMARC Group is a leading market research company offering management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic, and technological developments for pharmaceutical, industrial, and high-technology business leaders. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145