Introduction

Embedded finance has rapidly evolved from a niche innovation to a mainstream strategy that powers modern digital ecosystems. From ride-hailing apps offering instant driver payouts to e-commerce platforms giving shoppers buy-now-pay-later options, embedded finance weaves financial capabilities directly into non-financial experiences. This tight integration depends on a sophisticated stack of APIs, SDKs, and infrastructure components that allow businesses to deliver banking-grade services without building a bank from the ground up.

Definition

Embedded finance refers to the integration of financial services – such as payments, lending, insurance, or banking – directly into non-financial products, platforms, or customer experiences. Instead of using traditional financial institutions separately, consumers can access these services seamlessly within the apps or services they already use, making transactions faster, more convenient, and more personalized.

What Is Embedded Finance?

Embedded finance refers to integrating financial products – payments, lending, insurance, accounts, cards, investments – directly within a non-financial company’s digital workflow. Instead of redirecting customers to banks or third-party institutions, businesses can offer financial functions as part of their own UX.

Examples include:

- Retail brands offering store-branded debit accounts or installment loans

- Marketplaces embedding merchant onboarding and payouts

- SaaS platforms providing integrated invoicing and payment acceptance

- Logistics companies providing fleet insurance directly in their portals

This integration relies on a modular architecture: fintech infrastructure providers expose financial capabilities through programmable interfaces, and companies consume these capabilities through APIs and SDKs.

APIs: The Core Building Blocks of Embedded Finance

At the heart of embedded finance is the Application Programming Interface (API). APIs allow software systems to communicate with financial infrastructure in a structured, secure way. They abstract away the complexity of regulatory requirements, bank integrations, and risk management, enabling developers to embed financial workflows with minimal friction.

Types of APIs Commonly Used in Embedded Finance

1. Payments APIs

These handle card payments, bank transfers, digital wallets, recurring billing, and payout scheduling. They enable:

- Tokenization of card data

- Payment authorization and capture

- Refunds and disputes

- Real-time or same-day payouts

Payment APIs often plug into multiple rails—Visa, Mastercard, ACH, RTP—to maximize coverage.

2. Banking APIs

Banking-as-a-service providers use APIs to let businesses create:

- FDIC-insured accounts

- Virtual accounts with unique routing and account numbers

- Transaction monitoring

- ACH origination

- Debit card issuing

These APIs reduce the need to interact directly with traditional core banking systems.

3. Identity and KYC APIs

Regulatory compliance demands robust identity checks. KYC/KYB APIs offer:

- Document verification

- Biometric checks

- AML watchlist screenings

- Business entity verification

- Beneficial ownership checks

They integrate onboarding flows directly inside a business’s UI.

4. Lending and Credit APIs

These enable companies to embed:

- Buy-now-pay-later (BNPL)

- Credit scoring

- Automated underwriting

- Loan disbursement and repayment tracking

Lenders can tailor decisioning models using API inputs.

5. Insurance APIs

Insurance-as-a-service APIs provide:

- Policy creation

- Pricing

- Claims initiation

- Coverage management

They allow partners to embed micro-insurance or usage-based insurance.

SDKs: Accelerating Integration and Reducing Development Time

While APIs provide the underlying capabilities, Software Development Kits (SDKs) streamline implementation by offering prebuilt components, libraries, and UI modules.

Why SDKs Matter

- Faster integration: Developers can plug in ready-made components rather than coding from scratch.

- Consistent user experiences: UI kits ensure compliance and user-friendly flows.

- Reduced security risk: Proper encryption, tokenization, and data handling are baked in.

- Better maintainability: Updates, patches, and new features come bundled.

SDKs typically include:

- Client libraries (JavaScript, Python, Swift, Kotlin, Java, etc.)

- Mobile UI components for onboarding, payment collection, and document uploads

- Web widget frameworks

- Secure storage and tokenization utilities

For example, a KYC SDK may include a prebuilt mobile screen for ID scanning, selfie capture, and document submission – saving weeks of engineering work while ensuring regulatory compliance.

Deep Dive: The Technical Infrastructure Behind Embedded Finance

Beyond APIs and SDKs, several foundational layers power embedded financial experiences.

Banking-as-a-Service (BaaS) Layer:

This is the regulated backend infrastructure provided by licensed banks. BaaS platforms expose capabilities such as:

- Ledger systems

- Deposit accounts

- Card issuing

- Compliance operations

- Payment rails access

They act as the regulated foundation upon which fintechs and platforms build.

Orchestration and Middleware Layer:

Embedded finance often requires orchestrating multiple API providers—payments, KYC, banking, lending, etc. Middleware handles:

- Workflow routing (e.g., run KYC → create account → issue card)

- Error handling

- Provider switching and redundancy

- Data normalization across providers

This layer is essential for resilience and scalability.

Compliance and Risk Management Engines:

Compliance automation is a core advantage of third-party embedded finance providers. These engines include:

- AML transaction monitoring

- Suspicious activity detection

- Fraud scoring

- Identity verification logic

- Regulatory reporting automation

Every financial operation must pass through these filters to ensure legality and security.

Ledgering and Transaction Systems:

Accurate real-time ledgering is essential when dealing with money movement. The ledger system:

- Records every financial transaction

- Ensures double-entry accounting

- Supports account reconciliation

- Tracks balances and liabilities

Modern fintech ledgers are event-driven, highly scalable, and support real-time updates.

Security and Encryption Layer:

Financial data requires the strictest security standards:

- PCI-DSS for card data

- SOC 2 for organizational security practices

- Encryption at rest and in transit

- Tokenization of sensitive identifiers

- Role-based access control (RBAC)

SDKs often embed secure storage and tokenization to reduce developer burden.

Developer Tooling and Sandbox Environments:

To encourage adoption, fintech infrastructure providers offer:

- Interactive API docs

- Code samples

- Simulators for payment failures, chargebacks, and KYC outcomes

- Webhooks testing environments

- CLI tools

These tools drastically shorten the development lifecycle.

Putting It All Together: A Practical Example

Consider a SaaS platform for freelancers that wants to offer:

- Instant account creation

- Integrated invoicing and payment acceptance

- On-platform debit cards for spending earnings

- Automated tax savings accounts

Using embedded finance:

- KYC SDK handles onboarding and identity verification.

- Banking API creates a virtual account for each freelancer.

- Payments API processes incoming invoices and payouts.

- Card issuing API generates debit cards.

- Ledger system tracks incoming payments, balances, and tax allocations.

- Compliance engine monitors transactions for fraud and AML risks.

- UI components from SDKs integrate seamlessly into the SaaS dashboard.

The SaaS company avoids the cost and complexity of becoming a bank while offering end-to-end financial functionality.

The Future of Embedded Finance

The tech stack behind embedded finance continues to evolve toward:

- More unified orchestration layers

- AI-driven fraud detection and risk scoring

- Instant, API-native payment rails

- Composable financial products

- Global expansion with multi-region compliance

As more industries embrace embedded finance, the importance of modular APIs, developer-friendly SDKs, and highly scalable backend infrastructure will only grow.

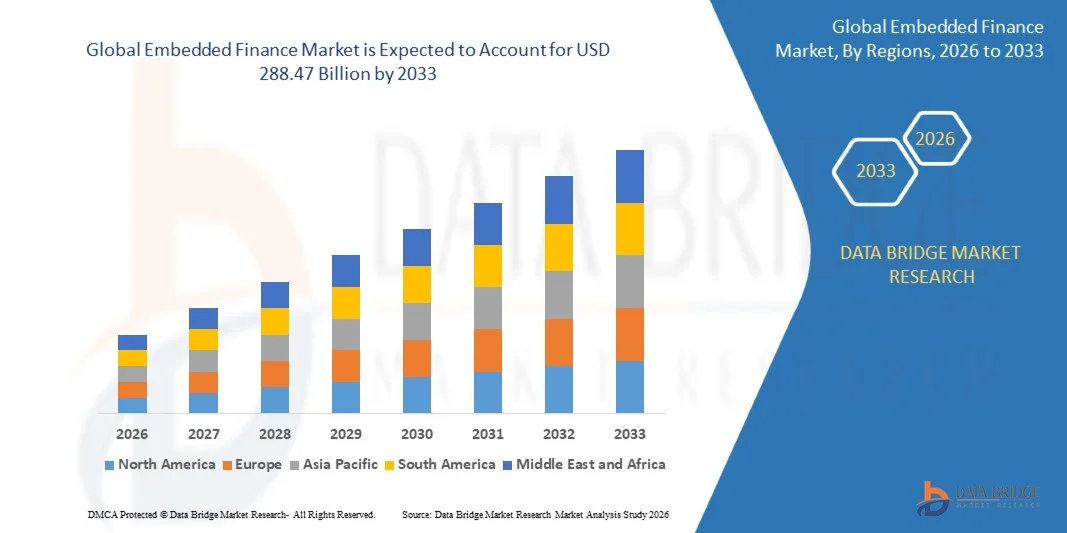

Growth Rate of Embedded Finance Market

According to Data Bridge Market Research, the size of the global embedded finance market was estimated at USD 112.67 billion in 2025 and is projected to grow at a compound annual growth rate (CAGR) of 12.47% to reach USD 288.47 billion by 2033.

Learn More: https://www.databridgemarketresearch.com/reports/global-embedded-finance-market

Conclusion

Embedded finance transforms how businesses interact with customers by placing financial capabilities exactly where users need them. This transformation is powered by a layered tech stack: APIs that expose financial functionality, SDKs that simplify implementation, and backend systems that ensure security, compliance, and operational excellence.