Canada Payments Market Overview

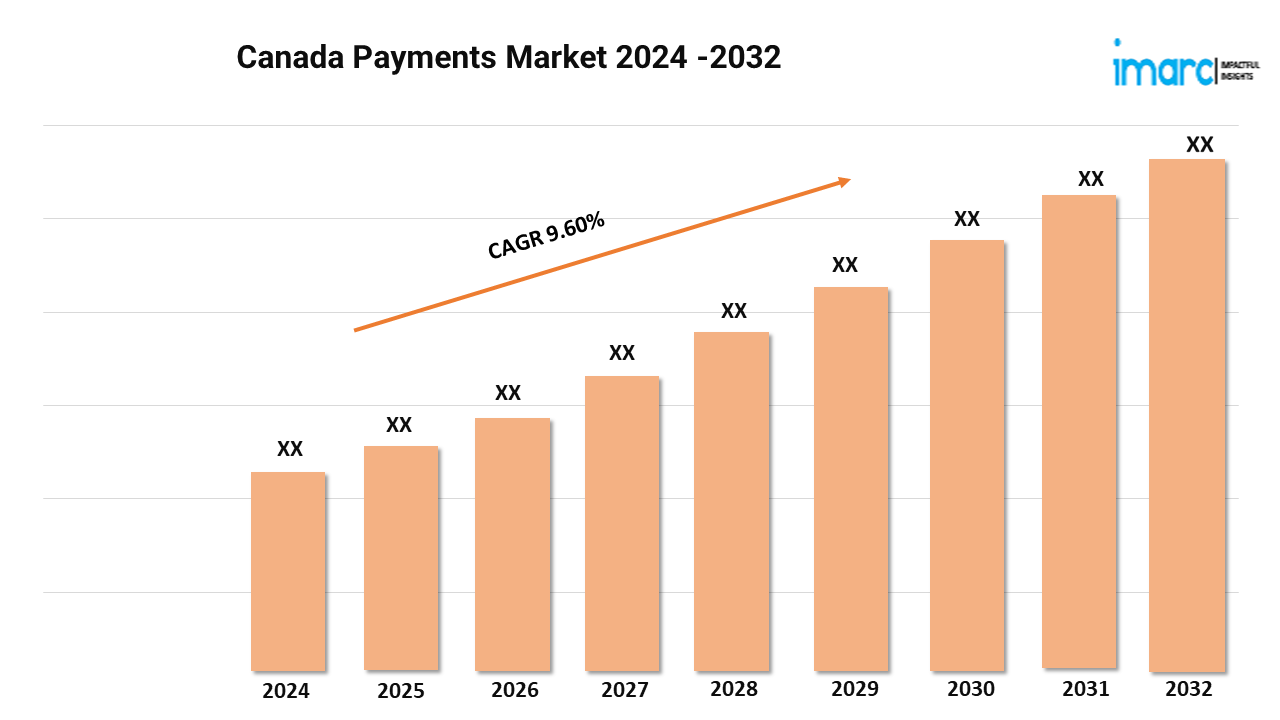

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 9.60% (2024-2032)

Market Size in 2023: USD 13.6 Billion

Market Forecast in 2032: USD 31.1 Billion

The Canadian payments market is undergoing significant transformation, owing to rapid technological advancements and evolving consumer preferences. According to the latest report by IMARC Group, the market size reached US$ 13.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 31.1 Billion by 2032, exhibiting a growth rate (CAGR) of 9.60% during 2024-2032.

One of the significant trends is the increasing adoption of digital and contactless payment methods. As consumers and businesses alike seek convenient and secure ways to conduct transactions, digital wallets, mobile payments, and contactless cards have gained substantial traction. The COVID-19 pandemic accelerated this shift, as Canadians turned to online and contactless payment options to minimize physical interaction. Another prominent trend is the growing emphasis on cybersecurity and fraud prevention. As digital payment volumes rise, there is a heightened focus on securing transactions and protecting sensitive data. This is prompting payment providers to integrate advanced security technologies, such as biometric authentication, multi-factor authentication (MFA), and blockchain. Moreover, the rise of open banking in Canada is facilitating greater competition and innovation in the payments sector. By allowing consumers to share their financial data with third-party providers, open banking is influencing the development of personalized payment solutions, such as tailored budgeting tools and enhanced payment experiences.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/canada-payments-market/requestsample

Canada Payments Industry Trends and Drivers:

The Canada payments market is primarily driven by the rapid shift toward digital and mobile payments which is spurred by consumer demand for convenience and security. The increasing use of smartphones and wearable devices is helping seamless transactions, with mobile wallets like Apple Pay, Google Pay, and Samsung Pay becoming mainstream payment methods. These solutions enable consumers to make payments with a tap of their device, significantly enhancing the ease and speed of transactions. Additionally, the rising popularity of e-commerce and online shopping is another notable factor contributing to the growth of digital payments. As Canadians embrace online shopping, payment systems have evolved to support a variety of digital methods, from credit card payments to alternative payment solutions like PayPal and e-transfers. The shift toward a cashless society, driven by both consumer preferences and the governmental focus on reducing cash usage for hygiene reasons, is further accelerating the adoption of digital payment systems. Government initiatives, such as the implementation of real-time payments and the development of open banking, are also playing a critical role. Open banking allows third-party providers to offer innovative financial products and services, making payment systems more diverse, efficient, and user-friendly. Apart from this, the increasing penetration of the millennial and Gen Z demographics, who are more digitally proficient, is pushing for innovations in payment solutions that prioritize speed, security, and convenience.

Canada Payments Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Canada payments market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

The report has segmented the market into the following categories:

Mode of Payment Insights:

- Point of Sale

- Card Payments

- Digital Wallet

- Cash

- Others

- Online Sale

- Card Payments

- Digital Wallet

- Others

End Use Industry Insights:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=23898&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145