Philippines Insurance Market Overview

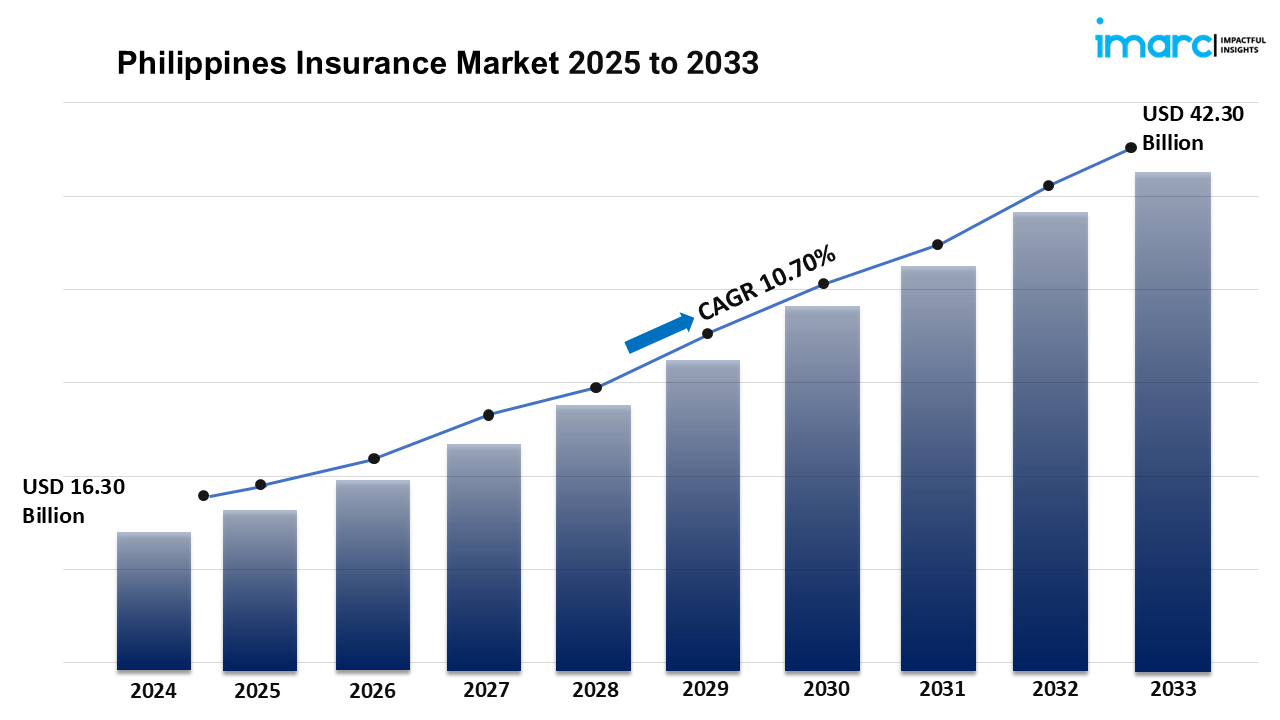

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 10.70% (2025-2033)

Market Size in 2024: USD 16.30 Billion

Market Forecast in 2033: USD 42.30 Billion

The Philippines insurance market is experiencing robust growth, driven by a confluence of economic expansion, increasing disposable incomes, and heightened awareness of financial protection. As the country continues progressing towards greater financial inclusion, consumers are actively seeking insurance solutions that offer comprehensive coverage, affordability, and accessibility. The rapid digital transformation across financial services is reshaping the industry, enabling seamless policy issuance, claims processing, and customer engagement. Moreover, the government’s supportive regulatory framework is fostering a more competitive landscape, encouraging both domestic and international insurers to expand their offerings. This evolving ecosystem is stimulating product innovation, particularly in health, life, and microinsurance segments, catering to the diverse needs of urban and rural populations. As digital adoption accelerates, insurers are integrating AI-driven analytics, automated underwriting, and blockchain technology to enhance transparency, efficiency, and risk assessment capabilities.

Philippines Insurance Market Trends and Drivers

In the United States, the key drivers of the insurance market expansion are technological advancements, evolving consumer preferences, and regulatory enhancements. The increasing demand for personalized insurance plans is pushing insurers to leverage big data and predictive analytics, enabling them to tailor policies based on individual risk profiles. The surge in insurtech investments is further revolutionizing the sector, introducing AI-powered chatbots, digital-first policies, and seamless mobile applications that streamline customer interactions. Additionally, the growing emphasis on cybersecurity insurance reflects the rising concerns over data breaches and cyber threats, prompting businesses and individuals to seek comprehensive protection. The United States’ dynamic regulatory environment is also playing a crucial role in shaping market growth, with evolving compliance standards ensuring consumer protection and fair competition among insurers. As digital ecosystems expand, insurers are prioritizing innovation-driven strategies to enhance customer experiences and sustain long-term profitability.

The global insurance landscape is undergoing a transformation, with insurers continuously adapting to shifting market dynamics and evolving consumer expectations. Emerging markets, including the Philippines, are witnessing an influx of strategic partnerships and technological integrations that enhance service delivery and market penetration. As digital literacy improves and fintech collaborations strengthen, insurance companies are introducing embedded insurance solutions that seamlessly integrate with e-commerce, banking, and healthcare platforms. The surge in telemedicine adoption is also reshaping the health insurance segment, enabling insurers to offer flexible coverage options tailored to virtual healthcare services. Meanwhile, sustainability and climate-focused insurance products are gaining prominence, addressing the increasing demand for environmental risk mitigation solutions. As the industry progresses, insurers are focusing on agile business models, leveraging data-driven decision-making, and implementing forward-thinking strategies to capture emerging opportunities and sustain long-term market growth.

Philippines Insurance Market Segmentation

The market report offers a comprehensive analysis of the segments, highlighting those with the largest market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments:

- By Type:

- Life Insurance

- Non-Life Insurance

- By Provider:

- Public Providers

- Private Providers

- By Distribution Channel:

- Direct Sales

- Brokers/Agents

- Bancassurance

- Online Platforms

- Regional Insights:

- Luzon

- Visayas

- Mindanao

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/philippines-insurance-market/requestsample

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145